Preface

Dear Reader:

I apologize for writing such a long report. What you’ll read in this report started with an article idea about skills-based environments. The idea was spurred by the increasing promotion of the concept by vendors and consultants and the early corporate initiatives I had heard about.

When I write an article, I normally outline 200–300 words to frame the main content. As my outline for a skill-based organization article reached more than 2,000 words, I realized the topic deserved a more thorough exploration than an article would provide. It seemed likely that readers would benefit from a logical, clear eyed, objective and fact-based review of every claim made and potential question about the skills topic.

The content for this article comes from the reports issued on the topic by the big consulting firms and some technology vendors. They are the ones making the claims and those claims are stated in their words – from Deloitte, Korn Ferry, PwC, McKinsey, Accenture and others. The analysis is my own and is based on applying my consulting knowledge of what works in organizations, doesn’t and why, and my practitioner’s nose for B.S.

My consulting firm does not have a proverbial dog in this fight. We do not sell skills-based or competency-based products or services. We do, in full disclosure, sell an experience map product that we love but you’ll see is in no way promoted by this report.

Our main aim is for you to be a careful consumer of the wealth of information you see daily about products and services that might help your business. We trust that our report will assist you in making informed choices on this important topic.

Best Regards,

Marc Effron, President, Talent Strategy Group

Executive Summary

Our report “Is the juice worth the squeeze? Questions about becoming a Skills-based organization” provides insights to the most critical questions about this rapidly emerging element of human resources.

Skills have been a standard element of job analysis for years but have recently been proposed as a pivotal and required element for organizations’ continued success. We ask questions in our report about why an organization should become skills-based and why now.

Skill-based organization proponents claim that the rapid evolution of organizations and the changes AI will bring demand greater organizational agility. They propose structuring not only roles, but entire companies, around matching, acquiring and building skills to ensure that organizations achieve that agility.

Substantive recommendations demand substantive arguments to support them. We find that the consulting firms and technology firms advocating for skills generally fall short of making a compelling argument. Their published material often engages in hyperbole, misdirection, unsubstantiated claims, contradictory internal logic, using convenience survey data as fact and proposing “skills” as the simple antidote to complex and multi-faceted organizational challenges.

The costs are obvious while the proposed benefits are diffuse. Organizations are told that they will need to fundamentally reorganize how they are structured, how they staff, how they train, how they pay and more. The costs and risks involved in such a massive transition that is independent of the firm’s strategy could be in the tens or hundreds of millions of dollars.

The benefits are stated as potentially increasing retention and applicant pools, creating more equitable organizations and even accelerating the transition to green jobs. There is no quantification of the benefits. And, as one consulting firm’s report ironically states, only a small majority of managers endorse working this way and not even 4 in 10 employees do.

Consulting firms’ reports and recommendations ignore simple, existing solutions to the stated challenges. For example, the fact that job descriptions contain degree requirements is consistently used as a reason to organize a company around skills. A simpler and far less disruptive change would be to simply remove degree requirements from job descriptions.

Our report details these challenges by asking and answering 17 questions about skills-based organizations. We provide seven additional information points for your consideration.

Happy reading and best of luck on your journey towards high performance.

Q1: Is there agreement about what a “skill” is?

A: No, and that’s a critical problem. If we can’t all agree on what something is, we certainly can’t redesign our entire company around it as many consultancies and vendors suggest. Most of those consulting firms do not define what skills are in their brochures and articles that promote them. Where they do, those definitions are fundamentally different.

- “We broadly define “skills” to encompass “hard” or technical skills (such as coding, data analysis, and accounting); human capabilities or human skills (such as critical thinking and emotional intelligence); and potential (including latent qualities, abilities, or adjacent skills that may be developed and lead to future success). Eventually, we see the word “skills” becoming short-hand for more granularly defining workers as unique, whole individuals—each with an array of skills, interests, passions, motivations, work or cultural styles, location preferences and needs, and more” says Deloitte.1

- “Goal-directed, well-organized behavior that is acquired through practice and performed with economy of effort” states Skill-net/Trinity College.6

- “The ability to perform a task or do something well” are skills according to Accenture.13

Deloitte’s definition is especially problematic given that it includes literally every element of a human being, both changeable and unchangeable. This means that they include both teachable skills (i.e. coding) alongside unchangeable elements of personality and intelligence.

If that’s not sufficiently confusing, Deloitte published a report in 2019 titled, “Skills change, but capabilities endure” that defines skills as “the tactical knowledge or expertise needed to achieve work outcomes within a specific context.”10

So, we have Deloitte’s 83-word definition (and their different 14-word version), Accenture’s 10-word definition and Skill Net’s 16-word version. When your CEO asks you, “What exactly are you building with your expensive skills initiative?” how will you explain to her what a skill is?

Perhaps more troubling, the World Economic Forum/PwC’s two substantial reports on skills, Korn Ferry’s skill brochure and Mercer’s skill report, among others, offer no definition of skills at all even as they stress their criticality. Gloat even includes a “skills glossary” in their “Ultimate guide to the skills-based organization” that includes definitions for terms including upskilling, cross-skilling and reskilling but it doesn’t include a definition of a skill. 2, 4, 7, 8, 20

If we can’t as a broader HR community agree what skills are, it is impossible to successfully recruit for them, build them, pay for them or any other action suggested by those advocating for a skills-based environment.

Q2: If a skills-based approach is needed, why is it needed?

A: There are multiple proposed benefits from having a skills-based organization and some benefits seem better supported by facts than others.

Claim: A skills-based approach will unlock hidden talent pools.

If we identify everyone’s list of skills, skills proponents suggest, there will be skills that people have but don’t use in their core job. This theoretically means that these skills can be deployed into another project, role or job. Or, an individual may have skills that could allow them to do a different job, project or gig, but because they’re “labeled” with their current job title, they can’t easily move into a different line of work.

For example, if you are a Finance Manager who dabbles in graphic design in your spare time, the theory is that you couldn’t get a job in graphic design because your resume or CV is all about finance. The promise of a skill-based approach is that you would inventory your graphic design skills in a system and that would allow you to be seen not only as a finance professional, but also as someone with specific skills in graphic design.

Response: Let’s call this the “efficient skills market” benefit from taking a skills-based approach. This benefit has appeal on its surface. There are millions of unfilled jobs globally. There are hidden skills in individuals that, if standardized and publicized would allow a better matching of people and jobs, project or gigs. It’s possible that by structuring people in “jobs” today rather than categorizing them by their skills, the employment market is not efficient in matching people to opportunities.

There are many factors, however, that will sharply limit any real benefit from a skills market.

1. Just because someone has “extra” skills doesn’t mean they want to deploy them: We can inventory that Finance Manager’s graphic design skills in a database. That doesn’t mean that the Finance Manager wants a job or project or gig in graphic design. They may be satisfied with graphic design being a hobby. They may earn far more money in finance than they would as a graphic designer.

There may be finance managers who want to redeploy themselves as graphic designers. But we can’t assume this will be a majority or even a sizable minority of finance managers.

Most people are in a role because they find a benefit in that role – pay, professional pride, mental stimulation. In other words, jobs are sticky and this sharply limits the potential of an efficient skills market.

2. Your “extra” skills may not match the roles available: The assumption of the efficient skills market is that there are many square pegs (skills) available that just need to be matched with the plentiful square holes (roles, jobs, projects, gigs). The global workplace statistics suggest that is not the case. Many job seekers don’t have the skills that are desired by employers that have open opportunities.

-

- Goldman Sachs reports that, “Record unemployment among China’s young people stems partly from a mismatch between their majors and available jobs.”14

- The National Institute of Economic and Social Research in the UK says that “we find that approximately 30% of graduates have too much education for their job, while 34% work in fields that are not related to their degree subject.”15

These facts, and similar ones worldwide, suggest that the challenge is that the available skills do not match the skills that are needed. This undercuts the claims that more efficient people matching will occur with a skills-based approach.

3. Your newly classified skills don’t make you the best qualified: People have different levels of skills. We shouldn’t expect that the Finance Manager’s graphic design skills will be competitive against the skills of a professional graphic designer with 10 years of experience in three different companies and who won a few awards for their graphic design.

The efficient skills market hypothesis falls down a little with the obvious statement that people who have been actively demonstrating their skills for a while are likely more capable than those who have not been doing that.

If a graphic design project is available, the more experienced person is more likely to get that project. The exception would be if the Finance Director is willing to work for the wages of an introductory graphic designer which, to point #1 above, is unlikely.

4. There are already external skills marketplaces for those who want to be in the freelance or gig economy. People who want to redeploy their skills already have marketplaces like Fiver, Upwork, Freelancer and others. They can keep their full-time job and offer their additional skills on those platforms. Since these platforms have at least national and sometimes global reach, they’ll provide a much wider variety of options that your internal marketplace.

Claim: Job descriptions have degree requirements that often limit the applicant pool unnecessarily.

Response: Absolutely. It’s silly to use the hurdle of a degree requirement where the degree is not relevant to the role or the requirement artificially limits the applicant pool.

There is an easy solution for that which doesn’t involve having to completely redesign your company around skills. Just remove the degree requirement from the job description. The rest of the job description should still have some value since it contains descriptions of skills, capabilities, competencies, and behaviors that are highly relevant to the project, role or job.

The benefits from removing degree requirements might not be particularly significant, however, since:

1. Only 6% of companies say that eliminating degree requirements would improve talent availability. These companies may be wrong, but it suggests that they would make this easy change if there were obvious benefits from making it. The fact that such a small number of companies believe this change will benefit them suggests that they see value in degree requirements.8 And, 81% of companies say they have already identified roles that don’t need degree requirements.9

2. Degree requirements can be valuable where they indicate specific skills: If you need to hire an electrical engineer, a logical starting point is to look for people who have an electrical engineering degree. That degree suggests that they have completed a course of study that has built the appropriate skills in electrical engineering.

Degrees have even more credentialing value for roles that require a master’s degree or Ph.D. in a highly technical area like biomedical research or nuclear engineering.

3. Without degrees, credentialing of some type is still needed: A company could eliminate degree requirements, but they would still need a way to assess if someone had the necessary electrical engineering skills. They could develop their own assessment. They could find an external body that conducts assessments of engineering skills. But each of those are simply a proxy for a degree requirement.

There is likely a benefit from things like coding courses or academies that help to build specific skills and provide a certificate of competence at completion. That is still an “education” requirement but one that costs far less and takes less time than earning a computer science degree.

McKinsey points out that the number one challenge companies cited as a barrier to moving to a skills-based environment is “validating skills, competencies and references” once they have removed degree requirements.9

Claim: A skills-based approach will increase the hiring of diverse and underrepresented groups.7, 9

Response: The arguments for this point are essentially identical to the arguments for removing degree requirements. We agree that if a degree or any other requirement is artificially limiting the potential talent pool, it should be removed. But, again, that doesn’t mean you need to reorganize your company around skills. Just remove the degree requirement.

1. The questions about the benefits to these groups are consistent with the challenges to removing degree requirements. There will still need to be some sort of screen to determine skills and some way for the candidates to acquire those skills.

2. This benefit would primarily be for entry level jobs. Most applicants to mid and senior level jobs are not being artificially screened out for lack of a degree if they have other experiences that clearly qualify them for the job. There also aren’t any facts we could find about the number of potential employees who could not find a role for this reason. Any benefit here is a good one, however, so just remove degree requirements from entry level job specs where they don’t add value.

Claim: Personal networks help people get jobs and that’s unfair. Using skills will create a more equitable job market. The PwC/World Economic Forum report says that “Personal networks still play too strong a role in hiring decisions, with 51% of workers believing that they have missed out on jobs or career opportunities because they don’t know the right people. . . Skills First approaches promote more equitable pathways to workforce participation based on “what you know” rather than “who you know”.

Response: This is both a unique and highly ironic claim. For those who don’t know, the World Economic Forum runs the annual Davos meeting attended by billionaires, heads of state, movie stars and famous others. One of the main reasons they hold Davos is to promote networking among these people. Does WEF see networking as beneficial for billionaires hunting for deals but harmful for those hunting for jobs?

Networking is open to everyone, albeit more difficult for some: Who you know and the networks you build will always matter. It should. A skills inventory is no substitute for having worked with someone and seen their performance firsthand.

And, everyone can network in some way. You may certainly have an advantage if Mom and Dad went to Harvard, then Yale, then McKinsey, etc. But anyone with a phone can get on LinkedIn and start to build a network.

Skills-based organizations and networking can co-exist. It seems unlikely that the entry-level jobs that would benefit most from a skills approach are all going to people with the “right connections.”

Finally, let’s remember that switching to a skills-based approach doesn’t create any skills. Unless the skills-based marketplace is far more efficient than expected, there aren’t significant benefit to unlocking a few skills given the significant effort and cost that is proposed.

Q3: Why focus on skills rather than on behaviors, competencies, capabilities or experiences?

A: Skills promoters don’t answer this question. Yet, it is perhaps the most important question to consider for the reasons we list below. Not only do they not provide a clear reason to choose skills over competencies or other options, there seems to be almost willful ignorance of the significant existing infrastructure around competencies.

1. Skills are the least holistic way to assess an individual. If we look at the classic “Iceberg” competency model of Dr. David McClelland (more on him below), you see that skills are just one element of an individual competency which can include knowledge, traits, motives and more. Why is it more compelling to organize people by skills than by something that reflects a more complete capability? After all, you can have skills a., b. and c., but what can you actually do?

2. Competencies already have an extensive infrastructure that mirrors what the skills-first movement is trying to create.

a. A little history for context: In 1973, Dr. David McClelland published an article in American Psychologist that fundamentally changed the practice of human resources. McClelland wanted to provide a fairer selection method for those who had been needlessly excluded from jobs by intelligence tests, race bias or gender bias.17

In “Testing for competence rather than for “intelligence,” he proposed that people should be evaluated for jobs using a measure that matched the individual to the job requirements. He called that measure a competency.

McClelland’s collaborators later defined “competency” as ‘an underlying characteristic of an individual, which is causally related to effective or superior performance in a job’ which could be ‘a motive, trait, skill, aspect of one’s self image or social role, or a body of knowledge which he or she uses’. (Boyatzis, 1982).

b. Here’s where history starts to repeat itself . . . : McClelland and Dr. Lyle Spencer formed McBer Consulting (later bought by Hay Group) which commercialized competencies as a way for organizations to assess, develop, move, promote and even pay their talent. That firm (and following them, many others) used competencies as the way to evaluate and fit people to jobs.

There were extensive taxonomies developed that charted competencies for a wide variety of roles and included proficiency levels for each competency. HR technology was built to incorporate these competencies, include rating individuals on competencies. Interview guides were developed to help assess candidate’s competencies.

It was imagined that an efficient competency marketplace would exist to help people move more easily around their company.

That story should sound extremely familiar since it’s the exact story told about skills. The question is, if competencies already exist as a well-developed, well-structured and well understood way of assessing people, why replicate competencies with skills? How does categorizing people by this bite-sized unit of ability provide any advantage over using competencies?

c. For that matter, let’s not forget experiences: Rather than skills or competencies, why not classify experiences that people need to succeed in a role, gig or project? This is the most holistic and outcome-oriented approach and a far more understandable approach to the typical employee – what experiences have you had vs. please list your 20 skills.

Companies like Pepsico were using experience maps 20 years ago as a more effective measure of, and development guide for, competence. We know of many companies that still use them today.

Another key fact to remember – most leaders couldn’t care less about their company’s competency model. Do you really think they’re going to care about the proposed skills model?

Q4: What changes will my organization have to make to become a skill-based organization?

A: According to the consulting firms’ literature, you will have to organize your entire company around skills and/or make meaningful changes in how people are managed.

- “It’s a complete re-imagining of how organization are structured and a mindset shift in the relationship between roles, people and business strategy.” And “Transformation to a skills based organization can disrupt some long-held cultural and structural norms related to responsibility boundaries, career progression, and succession planning. . . Without clear, communication and leadership buy-in at all levels, the magnitude of such a shift can have a destabilizing impact.”- Korn Ferry4

- “Leaders will need new mindsets, skills and support structures to lead through these shifts and into these very different models. HR teams will need the skills and capabilities to deconstruct work, codify talent pools, identify opportunities for automation and create the conditions for collaborative, agile teaming.”- Accenture13

- “(I)ncreasing projects and gigs requires changing how talent flows to work; work design changes what, whom and how work is performed; and workforce planning has far-reaching downstream impacts on talent assessment, development and flexible talent pools.” – Mercer2

- “(C)hallenges include the traditional siloed structure of HR organisations which places an emphasis on centres of excellence. Additionally, skills-first HR requires a change in the temporal orientation of HR teams towards a more future-oriented and proactive orientation. Skills-first HR requires an uplift in data quality, analysis and storytelling.” – Skillnet6

- “Instead, businesses need to embrace new frameworks and game-changing technologies in order to put skills at the center of their talent management strategy. . . With this change in approach comes an entirely new vocabulary for HR leaders to master.” – Gloat17

Once you move to being a skills-based organization, the work doesn’t end. According to Mercer, the average number of skills for a job typically hovers at about 20. They add “there are thousands of skills and new ones are being developed every day.” This suggests that you’ll need to have a significant number of staff to regularly assess the skills of every job and update each person’s 20 skills to ensure they are current. They mention that more than half of companies believe in either continuous assessment or annual assessment of skills.

There are even changes suggested that seem unrelated to skills. PwC/WEF says that companies will need to remove words that may be considered gendered from job descriptions, such as “decisive.” Their report suggests that AI do this task but doesn’t explain on what data that AI should be trained to identify gendered words while avoiding the bias that AI can inject on its own.

Q5: Will a skills-first approach allow better redeployment of employees as skill needs change?

A: There is an undeniable benefit if companies can redeploy talent across their organization as capability needs change. Whether skills enable this or enable it better than alternatives is uncertain. A few things to consider:

1. Do employees want to work in this environment? Deloitte says that skills will “Liberate work and workers from the confines of the job.” This begs the question of how many workers want to be “liberated” from the confines of the job to work in a more fluid, less predictable but perhaps more engaging environment.

Even Deloitte’s own data suggests they don’t. They report that 60% of business executives believe that “fractionalized work” is the best way to create value for workers and the organization. Just 38% of employees agree. And those questions don’t ask if the companies are willing to make the significant changes described in Q4 above to create a skills-based/fractionalized environment.

Do most employees want to grow and develop at work? Of course. Do they want to sign up for fractionalized work where they move between projects until their skills are no longer needed? The data suggests they do not.

2. Can employees be reskilled? Do they want to be reskilled?: One promise of a skills-based environment is that companies can retrain and redeploy workers as skills needs change. There’s obvious benefit if this can happen, but its success will be governed by the answers to two questions.

a) What capacity do employees have to learn new skills? There is no research we could find that suggests whether 10% or 90% of employees can be reskilled. If they can be, can they be reskilled only in skill areas adjacent to what they do today, or are they essentially a blank slate – reprogrammable with any new skill? The answer to that question is critical to evaluate whether your choice as an employer is to build or to buy skills.

b) Do employees want to be reskilled? We can safely assume that some employees have an affinity for what they do at work, and perhaps have invested considerable time and money in becoming highly skilled in their function. What percentage of those employees would prefer to be reskilled vs. finding another job that requires similar skills?

Obviously, employees whose skills are eliminated by technology or government regulation changes may have no choice but to adapt, although they can still choose to retire, stop working or rely on government assistance. But for those who enjoy their role (let’s think back to the Finance Director who dabbles in graphic design), they may like what they do and not want to be reskilled.

For organizations, there is also the key choice of whether to retrain for skills or buy skills. It may be far easier to purchase skills on the open market through recruiting or consulting or gig contracts, than to retrain employees. Buying skills gets them to you faster and those bought individuals should have more competence than employees who you have retrained.

If organizations choose to reskill, most will need to build fundamentally different approaches to learning and development that may resemble apprenticeships, university-like education curriculums, etc.

Q6: Is there any proof that a skills-based approach delivers results?

A: The specific claims of success made by consulting firms are preliminary at best, often anecdotal and reflect actions rather than outcomes.

- WEF/PwC does the best job of thoroughly describing firms that have implemented some skills-related programs. Some of the results they report seem promising but they are mostly measures of activities, not outcomes. For example:

- IBM: SkillsBuild program offers free skills-based education. 7 million learners enrolled in the program and they formed 45 partnerships with employment agencies.

- London Stock Exchange: Implemented a talent-marketplace and the targets they set of 15% greater internal mobility and 20% reduction in hiring “look realistic.”

- PwC applied a “skills-first” practice that reduced the hiring time by 45% compared to prior recruiting methods in one specific area.

- Siemens launched a My Skills program that now has 56,000 users. 200 “skills managers” were assigned to be “skills champions” in their organization unit.

While we congratulate these firms and the others mentioned in that report on their efforts, these activity metrics and results offer very little evidence for the benefits of a skills-based approach.

- McKinsey mentions that some small and medium-sized businesses that went through their training in skill-based hiring approaches stated that they were able to generate more candidates and others more qualified candidates. 9

- Deloitte says that organizations that embed a “skills-based approach” are 63% are more likely to “achieve results.” That sounds great until you read how each of those quoted phrases is measured.

- A “skills-based approach” is not a measure of whether and how a company uses skills. It is the response to employee survey questions like, “My employer treats workers as whole, unique individuals who can each offer unique contributions and a portfolio of skills to the organization” and “My organization supports me in pursuing opportunities to create value through activities that are outside of the direct scope of my job.” Those are very nice measures of attitude but it’s quite a stretch to claim that they measure a “skills-based approach.”

- Deloitte’s measure of “achieve results” in companies that have a “skills-based approach” may include meeting or exceeding financial targets, which is the correct measure although they don’t suggest that skills create those results. But they also measure “achieve results” as companies that positively impact society and communities served, improve processes to maximize efficiency and provide an inclusive environment.

Those are nice outcomes but I doubt that a shareholder or board member would suggest they provide the ROI needed from a skills investment. And, again, there is no claim that skills created those results, just that companies who meet the weak definition of “skills-based approach” will see those outcomes.

- Deloitte’s report and the WEF/PwC report tout Unilever as a firm that uses a skills-based marketplace to enable movement, but no statistics are provided about results. It’s also unfortunately worth mentioning that Unilever has been one of the world’s worst performing large company stocks over the past 5 years. Its stock has increased 7% compared to competitor Proctor & Gamble which is up 84% and the Dow Jones which is up more than 50%. While it’s nearly impossible to measure the stock price impact of an HR initiative, there is some value to using higher performing companies if you want to prove your case.2, 7

HiredScore VP Strategy and Research Ernest Ng points out that skills may not produce the outcome that companies are seeking. He says, “Call it skills or jobs, but at the end of the day, it’s experiences that create knowledge and wisdom. If the goal is to create a more knowledgeable and resilient organization, it’s not just about stashing and hoarding employees with skills, it’s about stashing and hoarding employees with a variety of experiences so the organization feels as prepared as possible to take on the uncertainty ahead.” 24

Finally, if you want skills to provide your company with a competitive advantage in attracting or retaining talent, it will have to execute how they manage skills better than the competition. If everyone has the same skills marketplace, skill development and other skill technology, then no company will gain a competitive advantage over anyone else.

The real value from having a skills-based environment would come from your company having one and none of your competitors having one. If there’s not a competitive advantage created, you’ve just added a cost to your company with unclear benefit.

Nearly any other investment your company makes requires some type of ROI or cost-benefit analysis. At this point in time, only the cost side is clear(ish) on skills-based approaches and there are only platitudes for the benefit side.

Q7: Is there a clear business case for becoming a skills-based organization?

A: No. As we describe in Q2 and Q5 above, there are a variety of claims about the reasons to be a skills-based organization that have questionable premises or unprovable assertions. WEF/PwC reinforces this point by saying that, “While the potential of the skills-first approach is increasingly recognized in general terms, no comprehensive, global, quantified estimate of the potential exists that could build the case for prioritizing the approach as a key business and policy imperative for leaders and decision-makers”8

PwC/WEF also says that, “it is important to link back to overall business and talent goals and establish aligned criteria to measure and document the benefits, return on investment and impact of pursuing a skills-first approach.” Their report doesn’t provide any actual financial benefits of skills and suggests that a company look to increased revenue or new products created as eventual metrics. Anyone with experience in HR analytics knows that it is impossible to isolate the added value of an initiative like this in macro metrics like revenue.

Q8: Can a skills-based approach solve organizational problems not solvable in other ways?

A: There is no proof presented by any consulting firm that it can.

Claim: Deloitte says that “confining work to standardized tasks done in a functional job, and then making all decisions about workers based on their job in the organizational hierarchy, hinders some of today’s most critical organizational objectives: organizational agility, growth, and innovation; diversity, inclusion, and equity; and the ability to offer a positive workforce experience for people.”¹

Response: Whenever a concept is promoted as a panacea to every problem in a company, you should look at it skeptically. If organizations can’t, as Deloitte claims, be agile, grow, innovate, be diverse, be inclusive, be equitable or offer a positive work experience without becoming a skills-based company, one should ask how any organization is surviving today. This type of unthoughtful hype adds nothing to the dialogue and feels like Deloitte is throwing the proverbial spaghetti against the wall to see what, if anything, sticks.

It’s also confusing when the other Deloitte report on skills says that “The marketplace and technological environment are changing in ways that make focusing on skills to the exclusion of all else a losing approach. . . Skills themselves are becoming less central to creating the type of value that will differentiate a company and help it build deep, long-term relationships with customers.”10

Q9: Will AI and technology solutions better enable companies to track, manage and match skills?

Claim: Technology and AI will allow companies to better match talent and jobs by classifying skills into a taxonomy and managing the mapping of people to jobs.

Response: Technology will certainly help to classify, analyze and store skills information. It will enable skill mapping to the extent that individual’s skills and role/project/job skills are accurate. But digitizing a concept that has questionable value doesn’t make it more valuable. Key challenges are:

- As described in Q1, there is no agreement on what a skill is, so your company may end up with a highly customized skill taxonomy. It certainly won’t create a single skills lexicon across companies, so a person’s list of skills in Company A may not translate into the skill definition used at Company B. This would prevent skills from being easily transferred from company to company. WEF/PwC recommends that governments step in and create master skill taxonomies for companies to use. 8

- As described in Q3, there is already plentiful HR technology that incorporates competencies. Yet competencies are not a tool that most leaders outside of HR care about. Why will placing skills definitions into technology make them any more utilized than competencies?

Q10: What type of technology is required to implement a skills-based organization?

A: We don’t provide an opinion on the type or value of technology because it exists to implement a solution whose value is still under debate.

So many of the positive claims about a skills-based environment depend on new technology being deployed to enable it. Mercer says that 64% of companies are not using technology to enable skills education mapping. It states that only 19% are using vendor provided technology.2 The other consulting firms’ reports all mention technology as a key enabler.

As you holistically evaluate our question “is the juice worth the squeeze” consider that these technology investments may reach multi-million dollars and, as an HR professional, you will need to justify that spend to your CHRO, CFO, and maybe even CEO. Given our earlier summary of the questionable benefits of skills, you should ensure that you find strong arguments for those investment conversations.

Q11: What type of organization will benefit from A skills-based approach?

A: Organizations that are naturally oriented around project-based work – consulting firms, construction and engineering companies, film/media companies, for example. These types of firms will benefit from any method that classifies their employees and their opportunities in a way that allows smart matching of resources. That doesn’t suggest that skills are a better approach than the existing language and tools of jobs, competencies or experiences to do this matching.

Q12: What type of individual will benefit from a skills-based approach?

A: Entry-level employees, those who have less formal education and those who have been voluntarily or involuntarily out of the workforce for a period could all benefit from an employment approach that creates fewer barriers to employment. Skills-based approaches are one option to lower barriers as are competency-based or experience-based approaches.

Employees within companies that want to stay with their organization can benefit from a skills-based approach, but they will benefit from any internal employment marketplace you establish.

Q13: Do jobs need to “devolve” into tasks and skills to meet the challenges of agility, technological innovation and AI?

A: There may be some benefit to that action but at an unknown cost, uncertain employee interest and competing solutions being available. One argument for shifting to a skills-based environment is that it will be impossible for companies to effectively respond to marketplace and technological changes with the current job-based structure.

John Boudreau and Ravin Jesuthasan, in their MITSloan Management Review article “Work Without Jobs” argue for a fundamental shift in how work is organized. They suggest moving away from traditional job descriptions towards a focus on individual tasks and projects to enable organizational agility. 19

In many ways, this is the “efficient skills marketplace” we discuss in Q2 above. The idea is not without merit, but implementing it requires a massive shift in how your company is structured and operates (see Q4), employees who want to work in that environment (see Q5), for uncertain benefits (see Q6) when the current job-based structure seems to be providing strong earnings for companies globally.

Workers also think of what they do in holistic, job-based ways. As one person I interviewed for this report said, “No one goes to a party and in response to the “what did you do today” question, replies with “some effective communication, problem-solving, and Python L4.”

The end of the job has been predicted for 30 years (or possibly more). We’ve seen some evolution but no revolution.

In a 1994 Fortune magazine article titled “The End of the Job,” William Bridges said, “The reality we face is much more troubling, for what is disappearing is not just a certain number of jobs — or jobs in certain industries or jobs in some part of the country or even jobs in America as a whole. What is disappearing is the very thing itself: the job.”

The logic that Bridges used is nearly identical to what skills advocates say today. Technology is evolving so quickly that companies can’t respond if people are in jobs. 21

He said that everything about how companies manage must be changed to respond to this new challenge. It may be helpful to note that this article was published a year or two before the internet became a thing, and that companies have prospered during and after that revolutionary technological change using the traditional structure of jobs.

In 1997, Tom Peters (who coauthored one of the first business best-sellers, In Search of Excellence) wrote an article in Fast Company titled “The Brand Called You.” In the article, Peters said. “the main chance is becoming a free agent in an economy of free agents, looking to have the best season you can imagine in your field, looking to do your best work and chalk up a remarkable track record, and looking to establish your own micro equivalent of the Nike swoosh. Because if you do, you’ll not only reach out toward every opportunity within arm’s (or laptop’s) length, you’ll not only make a noteworthy contribution to your team’s success — you’ll also put yourself in a great bargaining position for next season’s free-agency market.” 22

There has been progress towards Peters’ vision – the gig or independent worker economy is all about having sufficient brand to stay employed and make competitive wages. But Bridges’ call to end jobs has not been realized.

Q14: Who will assess if employees have skills?

A: Many of the consulting firms say, and most of the talent marketplace software, relies on self-reporting of skills. The creation of a “skills profile” for every employee is required for the talent marketplace to work.

Gloat defines this as, “A skills profile is a singular view that captures all of an individual’s skills, abilities, and experiences. They might include a summary of an individual’s work experience and certifications, as well as technical skills and any other relevant information that highlights their expertise. The purpose of a skills profile is to provide a comprehensive overview of an individual’s qualifications, making it easier for managers to assess whether or not they are a good fit for a particular project or opportunity.” 20

The significant challenge is that employees are typically expected to complete their own skills profile. Given the extensive science that shows most people overrate their capabilities, it’s not clear how an accurate skills profile will be constructed. Add this to the extensive science about which groups are more likely to overestimate their skills, and now that skills data is incredibly biased towards extroverted men.

Q15: Will a skills-based approach improve engagement?

A: “Opportunity to develop” is a key engagement driver for almost every company. It’s also, based on our knowledge, one of the lowest scoring items on many organizations’ engagement surveys. If using a skills-based approach helps employees to feel that they have more opportunities for development, this should contribute to increased engagement.

Q16: Do we need to be a skills-based environment to start a talent marketplace?

A: No, but the most current technology relies on skills as the currency of that marketplace. A marketplace simply means you are matching sellers of a product (people with capabilities) with buyers of a product (those who have jobs, projects or gigs to offer). You can certainly do that when the thing traded in the marketplace are jobs, projects, or skills. An old-fashioned job posting on your intranet counts as a talent marketplace.

Skills-based marketplaces promise to be a far more efficient way of matching people opportunities because of the technology, not necessarily because they’ve sliced jobs in skills. We acknowledge the benefits that organizations like Novartis have found through their marketplace. They acknowledge that the marketplace succeeds because of the technology, not necessarily because skills are the currency being used.

For a well-balanced article on the pro’s and con’s of talent marketplaces, read Dr. Allan Church’s article in TalentQ, “How To Tame The Talent Marketplace” at https://www.talent-quarterly.com/how-to-tame-the-talent-marketplace/

Q17: How predictively accurate are skills in determining performance?

Ideally the skills matched to the job will predict success in the job. How will companies determine which skills stand the best chance to differentiate performance?

A: Some companies may have plans to use skills to differentiate performance, but the current trend seems to be matching people and jobs. Knowing which skills allow a job to be performed is not the same as knowing which skills differentiate.

An open question is whether skills or competencies or some other way of slicing capabilities predicts success just as well as skills.

Additional Points

- Skills promotors are inserting the word “skills” in otherwise generic management advice to make it appear that there’s a novel or more effective approach using skills.

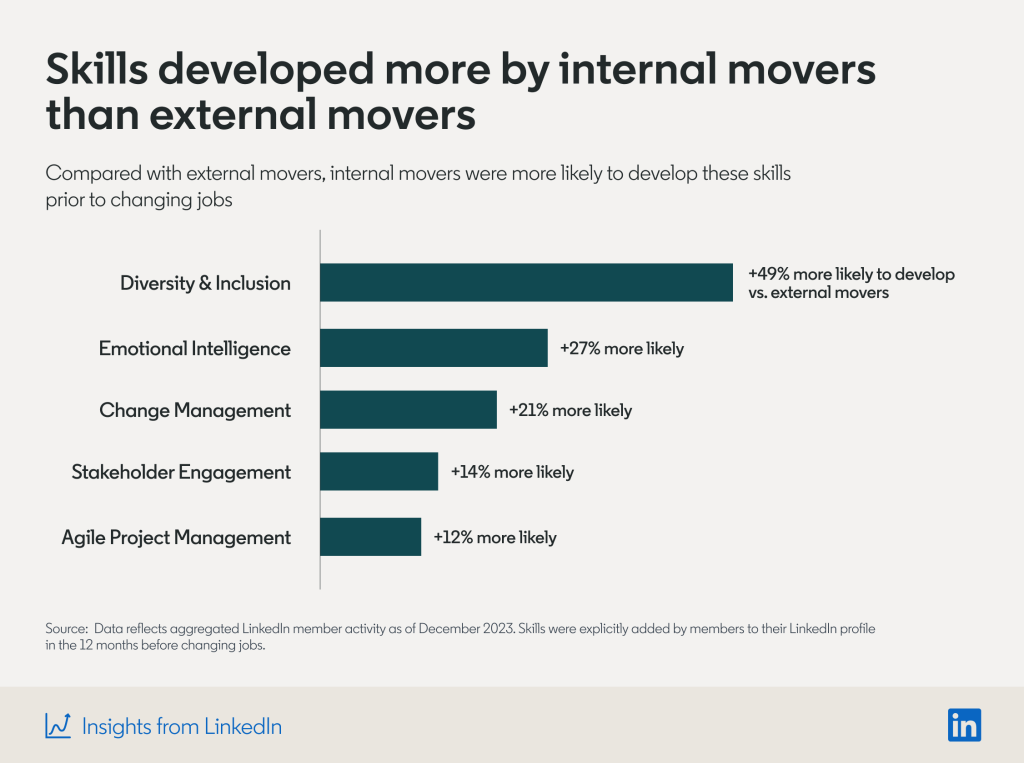

- Korn Ferry includes a five-step plan for “placing skill-building at the heart of talent and business strategies.” You can see that their chart recommends activities like “integrate learning and mentoring into the workday,” creating opportunities for feedback and focusing on building skills faster. These are good but completely generic recommendations that are in no way specific to a skills-based environment.

- They do offer one unusual piece of advice in this chart. Your company should “hire additional people to help bring current employees up to speed faster.” You might not want to mention that step to your CFO.4

- Consulting firms’ reports reinforce their claims using other consulting firms’ reports: Consulting firms regularly reference other consulting firms’ reports to justify their claims about the benefits of, or need for, skill-based environment. This results in “house of cards” logic where those who profit from a skills-based environments quote other consultants who profit from a skills-based environment to justify a skills-based environment. There is no clear-eyed, critical assessment of skills such as we provide in this report – just cheerleading.

- Korn Ferry cites the WEF/PwC report that 94% of leaders expect employee to pick up new skills on the job. 4

- WEF references a PwC report about youth employment challenges.7

- Gloat references Mercer that “2 in 5 HR leaders don’t know what skills they have in their workforce.”20

- HR processes exist today to develop and move employees: Many companies have learning and development departments, educational reimbursement programs, mentoring programs, high potential development programs, functional development programs, women’s leadership programs, access to self-paced learning like LinkedIn learning, coaching by direct managers and many other developmental tools.

Despite this wealth of resources, employees often don’t take advantage of them, and yet still complain about the lack of opportunities to develop. A skills approach may be the magic ingredient that causes employees to utilize a development tool and shift their attitudes about developmental opportunities.

- Consulting firms and individuals who promote skills-based environments and technology are sometimes paid by technology vendors for their promotion: Several people I interviewed for this report encouraged me to state that specific consulting firms and individuals are financially rewarded for promoting certain companies’ technology. They provided both names and dollar amounts to me. But, because I cannot independently verify that information I’m not including it in the report.

However, these opaque relationships mean that you should ask anyone promoting skills-based technology if they have any financial interest in the success of that technology, or are being paid by that technology vendor for their promotion of it.

- Accountability is missing from development processes today. Why will things be different with skills?: Our experience consulting with organizations across sectors, sizes and continents show us that managers have little accountability for development processes in most organizations. Development plans are rare and high-quality development plans nearly nonexistent. Leaders aren’t held accountable for improving the quality of their team. Employees aren’t held accountable (except through lack of promotion) for their own development.

If skills-based environments have any chance of working, there will need to be clear, explicit, and consequential accountability established for leaders and employees to use them. Given that this accountability has not been established for other potentially valuable development programs, we see little chance that this will somehow be applied to skill-based development.

- The promotors of skills-based solutions ignore the overwhelming influence of intelligence and personality factors in successful acquisition and demonstration of skills: The science is clear that personality and intelligence are the two largest drivers of success at work. Those two factors either help or hinder an individual’s abilities to gain and apply skills. No consulting firm report mentions those two factors. Although Deloitte, in their all-encompassing definition of skills, would theoretically classify elements of intelligence and personality as skills.

Intelligence is a fixed and unchangeable element of ourselves, and most personality factors are extraordinarily difficult to purposefully and sustainably change.

- There are already external skills marketplaces for those who want to be independent contractors, temps or gig workers: There are existing resources including sites like FiveR, Upwork, Freelancer, Toptal and other that match companies’ temporary opportunities to external talent who chooses to engage in freelance work.

- Companies have been remarkably successful and resilient over the past 20 years using jobs: If we look at the total size of just the US economy, it has grown from $11.06 trillion in 2002 to $25.46 trillion in 2022 (the latest year for which data is available). That is an annual grow rate of 4.32%.23 During that time, the US economy suffered two major recessions – one the “Great Recession” from 2007 – 2009, and one involving a near total shutdown of the country during the pandemic.

It has grown at that admirable pace despite companies being organized by jobs and with typical hierarchies. This doesn’t mean that skills can’t contribute to economic growth, but that the US economy has done remarkably well organizing their companies around jobs.

Conclusion

The good news is that if your skills initiative fails, no one’s going to die. It may cost the company a few million for a bad technology investment. It may hurt HR’s reputation to launch yet another “save the world” project that ends up not achieving that goal. It may cause the HR project leader some reputational damage from advocating so strongly for the skills initiative. But no one’s going to die if your initiative fails.

The bad news is there’s plenty of uncertainty about why this solution, why now and why will it work. HR has so many other areas it can first optimize to elevate performance in the company. They can improve goal setting, coaching, development planning, transparency of conversations about status and basic managerial behaviors among other areas. They can help leaders and employees execute the existing processes to plan and guide development.

At best, shifting to a skills-based environment can help some people in some situations at a large cost. It is likely best suited to industries where there is financial largess including pharmaceutical, banking, and larger consumer products firms.

At worst, it reflects HR’s continued pursuit of novelty with the giddy support of technology and consulting firms that are all-too willing to promote and enable this questionable solution.

For those reasons, our conclusion is that the juice of a skills-based environment as currently described is not yet worth the “squeeze.”

Original posted on TalentStrategyGroup